what is the income tax rate in dallas texas

2019-2020 MO and IS Tax Rates. Did South Dakota v.

This is the total of state county and city sales tax rates.

. Property Taxes in Texas. This marginal tax rate means that your immediate additional income will be taxed at this rate. Note that while most of Austin is subject to the 825 sales tax listed below the part of.

Texas has no state income tax. Its the local taxing units that do and they. For the 51000 to 89000 group its 72 percent after.

Select the Texas city from the list of popular cities below to see its current sales tax rate. The minimum combined 2022 sales tax rate for Dallas Texas is. Ad Compare Your 2022 Tax Bracket vs.

Tax Rate retail or wholesale 0375. Tax Rate other than retail or wholesale 075. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

Your marginal tax rate is 22 when you pay 23 in taxes. 2017-2018 MO and IS Tax Rates. For the 31000-51000 income group state and local taxes take an 84 percent bite.

The rate increases to 075 for other non-exempt businesses. Texas Paycheck Quick Facts. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas.

Discover Helpful Information and Resources on Taxes From AARP. 2020-2021 MO and IS Tax Rates. Income amounts are the higher of 30 of AFMI or the 2020 Poverty Guidelines published by the Dept.

Texas corporations still however have to pay the federal corporate income tax. Top state income tax rates range from a high of 133 percent in California to 1 percent in Tennessee according to the Tax Foundation study which was published in February. Texas has recent rate changes Thu Jul 01 2021.

2015-2016 MO and IS Tax Rates. The County sales tax rate is. However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the Texas sales tax and the Texas property tax.

Texas income tax rate. The state sales tax rate in Texas is 6250. 104 rows TOTAL TAX RATE.

Texas TX Sales Tax Rates by City. Income taxes accounted for 37 percent of state tax revenues in fiscal-year 2017 the analysis said. In fact the average tax rate in Texas is almost 8 higher than the national average.

Here are the numbers for texas. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825.

Of Health and Human Services. EZ Computation Total Revenue Threshold. That said it isnt the state itself imposing these taxes the Comptroller does not collect property tax or set any rates.

Use the 30 of AMFI from the table below only for Public Housing and Section 8 programs. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. If you make 55000 a year living in the region of Texas USA you will be taxed 9295.

That means that your net pay will be 45705 per year or 3809 per month. 2016-2017 MO and IS Tax Rates. No Tax Due Threshold.

The Texas Franchise Tax. And among the 43 states that levy income taxes 41 tax wages or salaries while two. For high-earners the cost difference is amplified by a state income tax rate in California of 123 percent for filers earning 500000 and above and could be further inflated by a proposed state.

Texas has no corporate income tax at the state level making it an attractive tax haven for incorporating a business. Here are the rates for every county in Texas as well as the major cities. Your 2021 Tax Bracket to See Whats Been Adjusted.

Texas income tax rate and tax brackets shown in the table below are based on income earned between January 1 2021 through December 31 2021. The Texas sales tax rate is currently. 2018-2019 MO and IS Tax Rates.

Only the Federal Income Tax applies. 10 -Texas Corporate Income Tax Brackets. Wayfair Inc affect Texas.

Your average tax rate is 169 and your marginal tax rate is 297. Texas Sales Tax. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023.

Census Bureau Number of cities that have local income taxes. The Dallas sales tax rate is. Texas state income tax rate for 2021 is 0 because Texas does not collect a personal income tax.

Texas is one of seven states that do not collect a personal income tax. It has an average tax rate of 125. With local taxes the total sales tax rate is between 6250 and 8250.

On the other hand Texas property taxes absolutely exist. Tax Bracket gross taxable income Tax Rate 0. An individual making 80000 in the Southwest region of Texas USA will pay 10587 in sales tax.

Outlook for the 2019 Texas income tax rate is to remain unchanged at 0.

Best States To Retired In With The Lowest Cost Of Living Gas Tax Federal Income Tax Income Tax

Itr Filing Online Online Taxes Online Online Journal

5 Best Assisted Living Facilities Dallas Tx Assisted Living Assisted Living Facility Facility

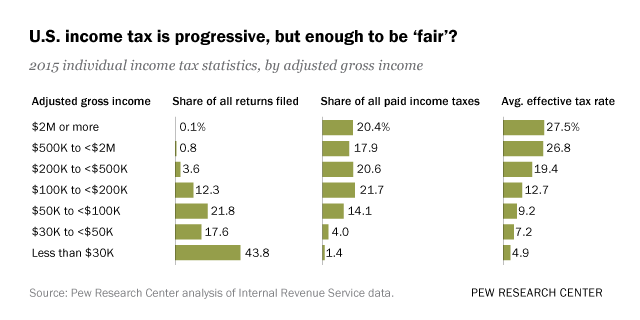

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

Taxable Income What Is Taxable Income Tax Foundation

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

ব তন ১৬ হ জ র ট ক হল ৩০ নভ ম বর র মধ য ই দ ত হব আয কর র ট র ন Income Tax Brackets Tax Services Tax Brackets

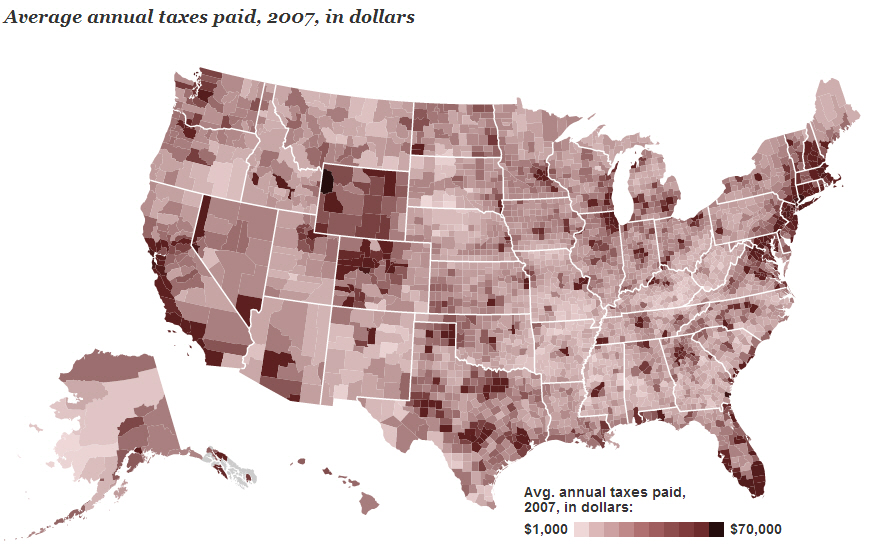

The Us Income Tax Burden County By County Tax Policy Center

Amerika Serikat Tarif Pajak Individu 2004 2021 Data 2022 2024 Perkiraan

Income Tax Brackets 2022 Which Are The New Tax Figures And Changes You Need To Know Marca

When Tax Returns Are Not Filed If You Are Seeking Help Filing Current Tax Returns The Team Of Tax Professionals At Our Firm C Tax Return Tax Help Tax Attorney

Take A Closer Look At Your Rights As A Taxpayer Which You Must Be Familiar With To Successfully Appeal Against An Irs Determination Irs Irs Taxes Appealing

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

What Is Income Before Taxes Income Economic Analysis Federal Income Tax

Where Do My Taxes Go H R Block Consumer Math Business Leader Financial Planning